Rumored Buzz on Hsmb Advisory Llc

Rumored Buzz on Hsmb Advisory Llc

Blog Article

Our Hsmb Advisory Llc PDFs

Table of ContentsHsmb Advisory Llc for Beginners6 Easy Facts About Hsmb Advisory Llc DescribedA Biased View of Hsmb Advisory LlcA Biased View of Hsmb Advisory Llc

- an insurance coverage business that transfers threat by acquiring reinsurance. - an adjustment in the rate of interest price, death assumption or booking method or other variables impacting the reserve calculation of policies in pressure.

- an expert designation granted by the American Institute of Building and Casualty Underwriters to persons in the property and obligation insurance policy field that pass a collection of exams in insurance coverage, threat monitoring, business economics, financing, monitoring, accounting, and legislation. Marks should additionally have at least three years experience in the insurance policy business or associated area.

- prices anticipated to be incurred about the adjustment and recording of accident and wellness, vehicle clinical and employees' payment insurance claims. - A sort of liability insurance policy kind that only pays if the both event that causes (triggers)the case and the real insurance claim are submitted to the insurance coverage business during the policy term - a method of determining rates for all candidates within an offered collection of attributes such as personal demographic and geographic area.

If the insured stops working to keep the amount specified in the condition (Typically at least 80%), the insured shares a greater proportion of the loss. In clinical insurance a percent of each claim that the guaranteed will birth. - a contract to receive settlements as the buyer of a Choice, Cap or Flooring and to make repayments as the vendor of a different Alternative, Cap or Floor.

Getting The Hsmb Advisory Llc To Work

- an investment-grade bond backed by a swimming pool of low-grade debt protections, such as junk bonds, separated right into tranches based upon various degrees of credit rating danger. - a kind of mortgage-backed security (MBS) with separate pools of pass-through safety home mortgages that contain varying classes of holders and maturities (tranches) with the advantage of predictable capital patterns.

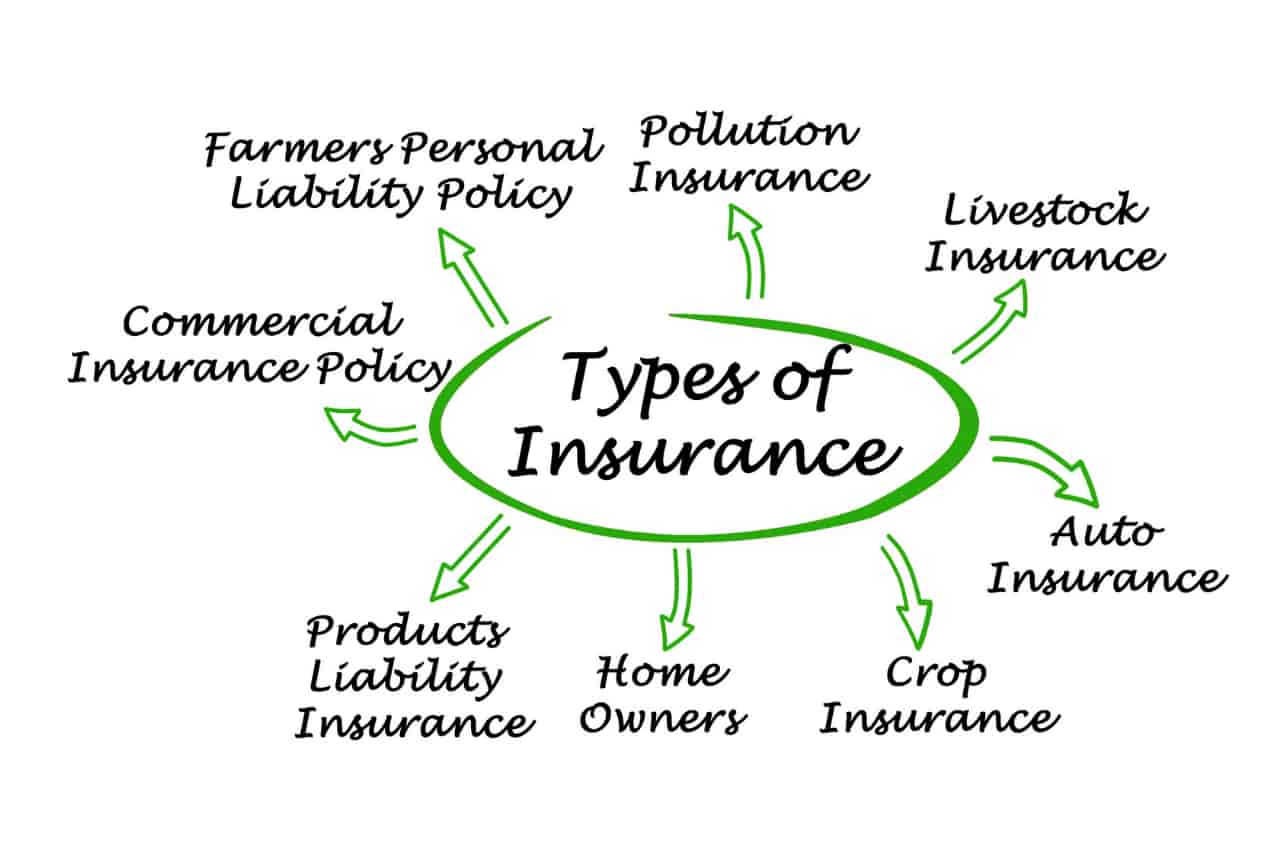

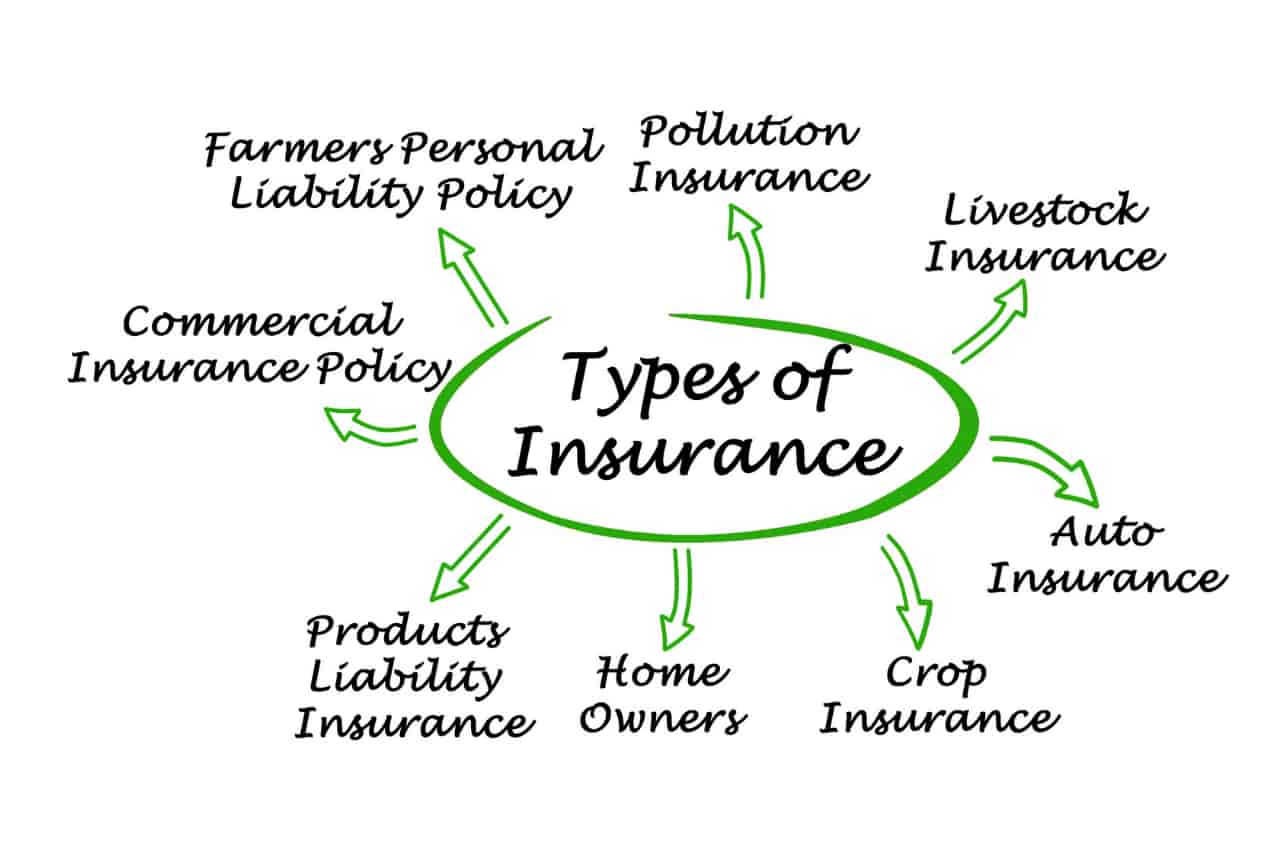

- an indicator of the productivity of an insurance provider, calculated by adding the loss and expense ratios. - date when the organization first ended up being bound for any type of insurance coverage danger by means of the issuance of plans and/or getting in right into a reinsurance arrangement. Like "reliable day" of coverage. Health Insurance. - protection for motor cars had by a service took part in business that shields the guaranteed versus monetary loss due to the fact that of lawful responsibility for car associated injuries, or damages to the building of others created by mishaps developing out of the ownership, maintenance, use, or care-custody & control of a car.

- earthquake building coverage for business ventures. - a business package plan for farming and ranching risks that consists of both residential or commercial property and responsibility coverage. Insurance coverage includes barns, stables, other farm frameworks and farm inland marine, such as mobile equipment and livestock. - different flooding insurance plan sold to business endeavors - https://www.easel.ly/browserEasel/14439798.

Some Known Details About Hsmb Advisory Llc

- a kind of mortgage-backed safety that is safeguarded by the funding on an industrial building. - policy that packages 2 or more insurance coverages protecting an enterprise from different building and responsibility risk exposures. Frequently includes fire, allied lines, various other insurance coverages (e. g., distinction in conditions) and responsibility insurance coverage.

- a ranking system where conventional rating is established and normally adjusted within certain guidelines for every group on the basis of expected application by the group's workers. - a five-digit identifying number designated by NAIC, appointed to all insurance coverage business filing financial information with NAIC. - plans covering the responsibility of service providers, plumbing technicians, electricians, service center, and comparable firms to persons who have incurred physical injury or residential or commercial property damages from malfunctioning job or procedures finished or abandoned by or for the insured, away from the insured's premises.

- coverage of all service responsibilities unless specifically left out in the plan agreement. - comprehensive responsibility insurance coverage for exposures occurring out of the house properties and tasks of people and member of the family. (Non-business obligation exposure defense for people.) - plans that provide fully guaranteed indemnity, HMO, PPO, or Fee for Service insurance coverage for health center, medical, and medical costs.

All about Hsmb Advisory Llc

- property loss sustained from two or even more risks in which just one loss is covered yet both are paid by the insurer due to synchronised event. - needs defined in the insurance agreement that need to be upheld by the guaranteed to receive indemnification. - house owners insurance policy sold to condo proprietors occupying the explained home.

- required by some territories as a bush versus damaging experience from procedures, particularly damaging case experience. - the liability of a guaranteed to persons who have actually incurred bodily injury or residential or commercial property damages from work done by an independent service provider hired by the guaranteed to carry out work that was prohibited, inherently hazardous, or directly monitored by the insured - legal or contractual arrangement calling for providers to supply treatment to an enrollee for some duration following the day of a Health insurance Firm's insolvency.

- books established up when, due to the gross premium framework, the future advantages exceed the future net premium. Agreement gets are in addition to insurance claim and costs gets. - liability protection of a guaranteed that has actually assumed the legal obligation of one more event by composed or dental agreement. Consists of a legal liability policy offering protection for all responsibilities and responsibilities sustained by a solution agreement service provider under the terms of service contracts provided by the supplier (https://www.huntingnet.com/forum/members/hsmbadvisory.html).

Report this page